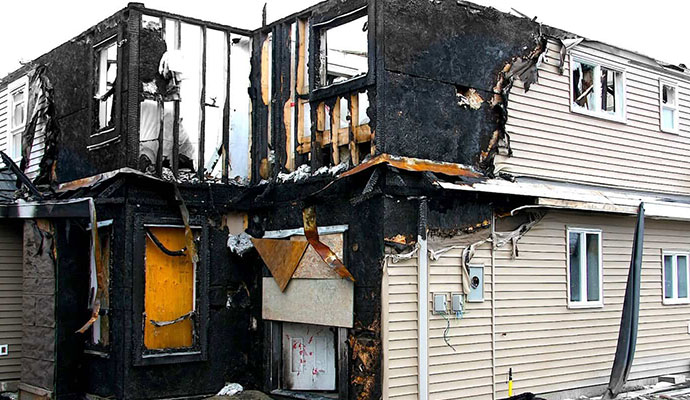

Steps For A Commercial Fire Damage Insurance Claim

If your place of business or property has experienced fire damage, you likely have questions about what to do next. You may wonder how it will affect normal business operations, what you should do, who you should call first, and if your insurance will cover all of the necessary costs.

Dealing with such a disaster is stressful and might seem overwhelming. There are steps you can take to make the process of getting back up and running as quick and efficient as possible. The following tips can help answer your questions and guide to getting your business or property repaired and running again.

Next Steps After Experiencing Fire Damage

You might think that the very first thing to do is call your insurance provider. While you wouldn’t be entirely wrong, there are some things you should consider before picking up the phone.

1. Should You File a Claim?

Automatically filing a claim might seem like the natural first step in the aftermath of a fire. If the fire only caused minor damage, however, filing a claim could end up unnecessarily raising your insurance rates. The cost of covering repairs for a small fire is sometimes below the deductible amount. This may make it easier and more efficient to simply pay out of pocket.

If you think the damage is minor enough that you’ll pay out of pocket, call your local restoration contractor first. They can evaluate the damage and give you an idea of the cost before you involve your insurance company.

2. Consider Business Interruption Coverage

When there is major damage to your business or property, one of your biggest concerns is likely the loss of revenue from the interruption to business operations. Though business interruption coverage is often included in the overall insurance policy, it can get complicated. Before speaking with your insurance company, read over your policy to see if business interruption coverage is included and how much it covers.

You should specifically mention filing a business interruption claim to your insurance agent if you will need it. Be prepared to bring in experts to evaluate the situation and provide comprehensive financial documentation to prove the impact of losing business due to the damage. As these types of claims are complicated, insurance providers can sometimes deny them or offer a reduced amount to simply resolve the claim. You may have to involve a lawyer to ensure your claim is fairly resolved.

3. Contact Your Insurance Company

If the damage to your business or property is extensive, you should contact your insurance company as soon as possible. They can review your policy with you and talk you through the steps you need to take to submit your claim. After your claim is reported, your insurance company will send an adjuster to assess the damage. Follow these tips to prepare for the adjuster and ensure the claims process goes as smoothly as possible:

- Take photos of the damage. Before the adjuster visits, make sure to thoroughly photograph or record a video of the property.

- Compile necessary business records.To properly file your claim, you will need to collect any relevant business documents to prove the value of the damaged property. This includes proof of income generated from the business, inventory records, receipts that show the cost of any damaged equipment. If you have it, also provide any records that might help prove the cost of the structures that were damaged.

- Keep records of repair expenses. After the adjuster has visited, you should continue to keep track of any costs incurred to repair the property. This includes any additional costs to protect the property from future damage.

4. Call a Trusted Restoration Company

After filing your claim, your next step is to call a damage restoration contractor to protect and repair your business or commercial property. There are lots of companies out there that claim to provide these services. To safeguard your property from further damage or complications, it is important to hire a company that is experienced and certified. Though your insurance provider may recommend a company, it is only a suggestion and is still up to you to choose a trusted restoration contractor.

Alpha-Omega Disaster Restoration has proudly served Billings, Montana, and the surrounding areas since 2006. Our team of skilled and certified experts is available 24/7 to help clean up and protect your property as soon as the fire occurs. We then work with your insurance to ensure repairs are completed efficiently and follow code.

Contact us today for more information on our restoration services.